Finding Answers to Business Challenges Just Got Easy

Connect 1:1 with the leading startup experts and get the help you need to take your business to the next level.

Trusted by over 201 Experts & 1158+ Entrepreneurs

Experts who work with big brands

HOW IT WORKS

Get insights you would never get by booking a session with industry leaders.

Find an expert

Discover and choose from our list of the world's most in-demand experts

Book a video call

Select a time that works for both you and your expert's schedule

Virtual Consultation

Join the 1-on-1 video call, ask questions, and get expert advice

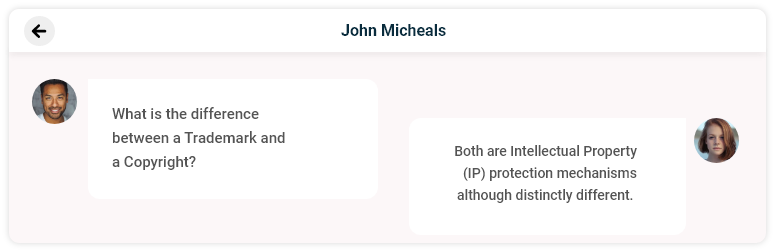

Chat messaging

Chat instantly with your mentor or mentee, anytime, anywhere.

Session scheduling

Simplify appointment management and free up valuable time.

Video calling

Build stronger relationships and get personalized guidance through live video calls

HELPING SMES IN SOUTH AFRICA

Bridging the Gap: Support for South African SMEs

Start my business

Discover and choose from our list of the world's most in-demand experts

Book a video call

Select a time that works for both you and your expert's schedule

Virtual Consultation

Join the 1-on-1 video call, ask questions, and get expert advice

Connect with leading Experts in South Africa

Empower your future with expert guidance. Find your South African expert and achieve your goals.

How Our Experts Can Help You

Get the answers you need. Our experts are here to guide you with their specialized knowledge.

Reviews

Get real insights from real people. Dive into our customer reviews and see what matters most.

Can't Find An Answer?

Talk to us!